The Benefits of Using an Invoicing System for Billing and Payment Management

An invoicing system is specialized software designed to streamline billing and payment processes for businesses. By automating invoice generation, payment management, and cash flow optimization, an invoicing system offers a range of benefits that can greatly enhance financial operations.

Efficiency: By automating the invoice generation process, an invoicing system significantly improves efficiency. It eliminates the need for manual invoice creation, allowing businesses to save time and allocate resources to more critical tasks.

Accuracy: An invoicing system reduces the likelihood of errors in calculations and data entry. With automated processes, businesses can generate accurate invoices and ensure the precise application of discounts, leading to improved financial accuracy.

Time-saving: Automation through an invoicing system allows for swift invoice creation, delivery, and payment processing. Businesses can save substantial time by eliminating manual paperwork, reducing administrative burden, and improving overall productivity.

Enhanced Cash Flow: With an invoicing system, businesses can expedite the invoice generation and payment collection processes. This streamlined approach improves cash flow by reducing the time it takes to receive payments, providing greater financial stability.

Cost Reduction: Implementing an invoicing system leads to cost savings by eliminating the need for paper, printing, and postage associated with traditional invoicing. Moreover, businesses can reduce labor costs by minimizing manual invoice handling tasks.

Improved Customer Experience: An invoicing system enables businesses to deliver professional and accurate invoices to their customers. This enhances the customer experience, fosters trust, and establishes a positive brand reputation.

How Does an Invoicing System Work?

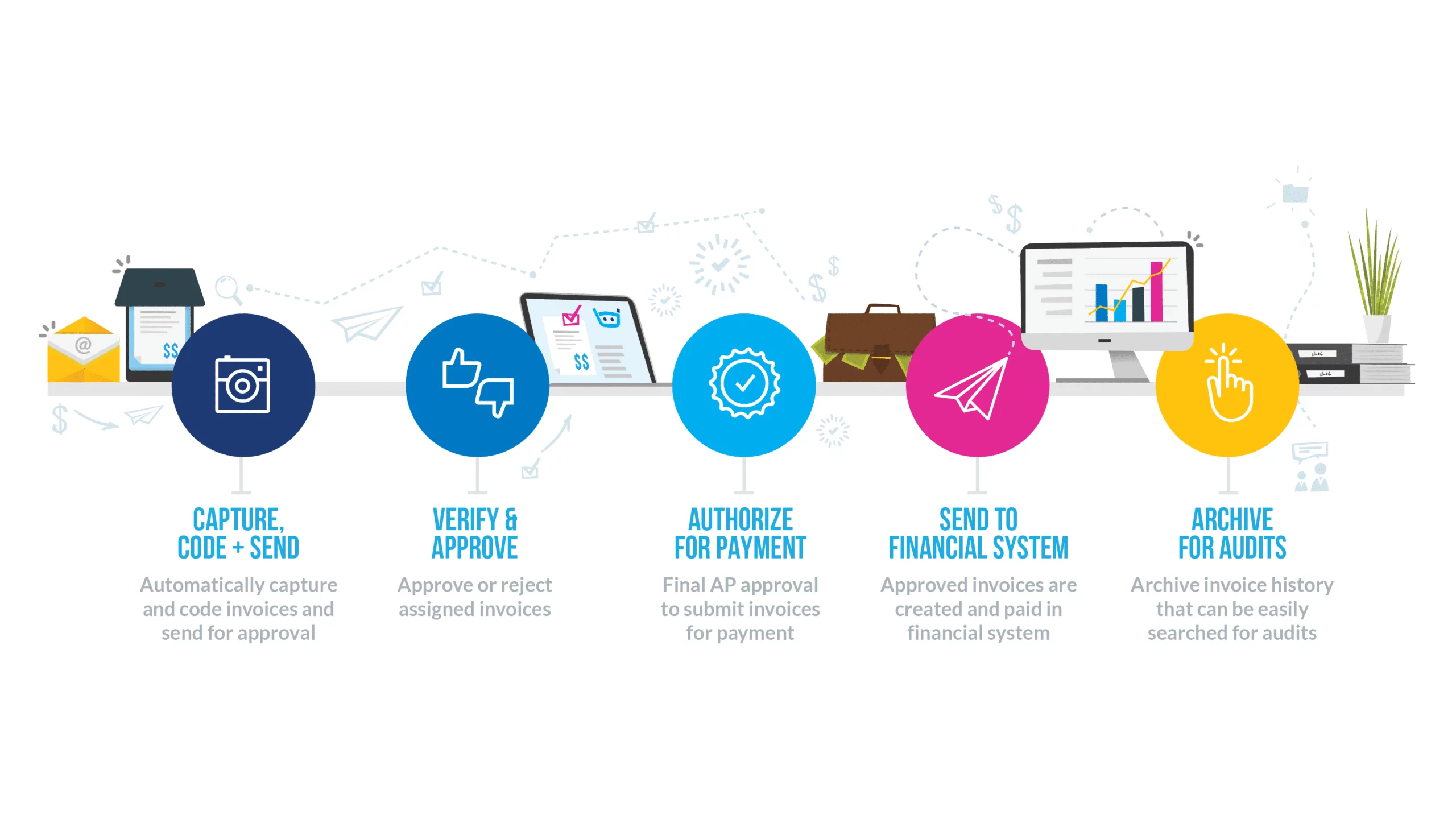

An invoicing system automates various aspects of billing and payment management. Here is a simplified overview of its functioning:

Invoice Generation: The system automatically generates invoices using pre-defined templates and customer data, eliminating manual entry and ensuring consistency.

Delivery: Invoices can be sent electronically via email or customer portals, providing a convenient and environmentally friendly method of delivery.

Payment Processing: The system integrates with payment gateways, enabling customers to make online payments using various methods such as credit cards or digital wallets.

Payment Tracking: An invoicing system tracks payment status and sends reminders for overdue payments, enabling businesses to stay on top of outstanding invoices.

Reporting: Businesses can generate comprehensive reports on invoice status, payment history, and cash flow. These reports offer valuable insights for financial analysis and decision-making.

Choosing the Right Invoicing System

Consider the following factors when selecting an invoicing system for your business:

Features: Look for an invoicing system that offers essential features such as automated invoice generation, payment integration, reporting capabilities, and customization options to align with your specific business requirements.

Scalability: Ensure that the invoicing system can accommodate your business’s growth and handle an increasing volume of invoices and customers.

Integration: Check if the system can integrate with your existing software, such as accounting or customer relationship management (CRM) systems. Integration facilitates seamless data flow and enhances operational efficiency.

User-Friendliness: Opt for an invoicing system with a user-friendly interface and intuitive navigation. This ensures easy adoption and minimizes the learning curve for your team.

Support: Select an invoicing system provider that offers reliable customer support, including training resources and technical assistance, to facilitate smooth implementation and ongoing usage.

By implementing the right invoicing system for your business, you can streamline billing and payment management processes, improve efficiency, reduce errors, and enhance cash flow. An automated invoicing system empowers businesses to focus on their core operations, cultivate customer satisfaction, and drive growth.

Invoicing System

An invoicing system is a software solution that automates the process of sending invoices and collecting payments . It is an essential tool for businesses of all sizes and industries, providing a streamlined way to manage payment status, platform integration, calculations, pricing, and gateway providers.

With an invoicing system, businesses can schedule and automate invoice generation, send reminders, and track payments . Payment authorization and alerts can be set up to ensure timely payments and avoid late fees. The integration of payment gateways allows businesses to offer a variety of payment methods, such as credit cards, bank transfers, and digital wallets.

One of the key features of an invoicing system is its ability to generate billing reports for data analysis. Businesses can easily track revenue, cash flow, and profit through a billing dashboard. The software also provides payment reconciliation tools, ensuring that all received payments are matched with their corresponding invoices .

An invoicing system enhances communication with customers by providing payment notifications, balance updates, and other important information. It can also handle recurring billing for subscription-based services or ongoing contracts, simplifying the payment process for businesses and customers.

Overall, an invoicing system is a versatile tool that streamlines payment processes, increases efficiency, and improves cash flow. It provides a secure and scalable solution for managing invoices , payments , and customer communication, allowing businesses to focus on their core operations and driving growth.

Benefits of an Invoicing System:

- Automated invoice generation

- Payment tracking and alerts

- Integration with multiple payment gateways

- Billing reports for data analysis

- Payment reconciliation tools

- Enhanced customer communication

- Recurring billing for subscriptions and contracts

- Streamlined payment processes

- Improved cash flow

- Secure and scalable solution

Conclusion

An invoicing system is an essential software solution for businesses to streamline their payment processes and improve efficiency. By automating invoice generation, tracking payments , and providing communication tools, businesses can focus on their core operations and drive growth. With the additional features of billing reports and payment reconciliation, an invoicing system offers a comprehensive solution for managing invoices , payments , and customer communication.

Automate Your Invoicing and Payment Reminder System

Effective accounting is crucial for any company to thrive. An automated online invoice and payment reminder system can streamline your financial processes, making them more efficient and less time-consuming. Implementing the right billing software can simplify collaboration, time tracking, and transaction analytics while providing standard invoice templates for small business needs.

With an automated system, you can keep accurate records of your customer invoices, payment authorization, and expenses. Cloud-based software offers the advantage of accessing your data from anywhere with an internet connection, whether you are in the United States or elsewhere.

Furthermore, automated systems provide a range of payment gateway options, allowing your customers to choose the most convenient method. Compare different payment options and control how you manage transactions. Integration with other tools, such as CRM systems, ensures seamless communication between different aspects of your business, improving overall management and helping you scale operations.

Automated systems also offer features like debit tracking, completed invoice tracking, and various payment options. You can create billable invoices with ease and track their status, ensuring no payment goes unnoticed. When customers have inquiries or issues regarding their payments, you can quickly address their concerns using the system’s inquiry management features.

Documentation of payment gateway services and APIs facilitates the secure transfer of payments, whether by credit card or other means. These gateways ensure the smooth flow of transactions and provide a secure environment for handling sensitive financial information, eliminating the need for chasing payments manually. For example, you can automate follow-up reminders for outstanding estimates and charges.

Moreover, automated systems can assist with billing and inventory management, keeping track of stock levels and generating invoices from your files accordingly. Tax calculations and credit adjustments can also be automated, minimizing errors and reducing the burden on accounting staff.

In conclusion, automating your strategy for invoicing and payment reminder systems with the right software can greatly enhance your financial processes. By leveraging cloud-based technology, efficient payment tracking, and collaboration tools, you can get paid faster, reduce errors, and improve the overall efficiency of your business. When you log in to your account, you will see the latest features to help you manage your finances effectively, including options to download receipts instantly and press forward with new careers in financial management.

Ensure Accurate and Timely Invoice Generation

Accurate and timely invoice generation is a crucial aspect of efficient accounts and invoicing management. To streamline this process and eliminate errors , businesses can leverage invoicing software that automates the invoice generation and payment tracking .

With the help of such software, businesses can create professional invoices with ease, ensuring that all necessary details such as customer information, billing cycle, fees, and expenses are accurately captured. This eliminates the need for manual entry and reduces the risk of billing errors.

Furthermore, the software can integrate with payment solutions and provide various payment methods for customers , including credit card processing and payment gateway platforms. This allows for convenient payment options and enhances customer satisfaction.

The software also facilitates customer management by providing a centralized platform to store customer information and maintain a record of their payment history. In case of any payment inquiries or disputes, businesses can quickly access the relevant data to resolve the issue efficiently.

In addition, the software offers advanced analytics and reporting features that provide insights into billing and payment trends. These analytics can help businesses identify areas of improvement, monitor vendor performance, and optimize expenses.

Moreover, multilingual and multicurrency capabilities enable businesses to cater to a global customer base , ensuring accurate billing and taxation for international transactions. This eliminates the loss due to currency conversion and simplifies the billing process.

Overall, the implementation of an invoicing software ensures accurate and timely invoice generation , streamlines billing and payment processes, enhances customer satisfaction , and provides businesses with valuable financial insights for efficient decision-making.

Track Your Outstanding Payments and Reduce Late Payments

Managing and tracking unpaid invoices is crucial for any business. An efficient invoicing system can streamline payment processes and reduce delays. By keeping track of unpaid invoices , you can ensure timely payments and improve cash flow.

A secure payment system allows you to generate professional invoices for every customer purchase. You can offer various payment options, such as credit card processing or cash, providing convenience for your customers.

For businesses working with suppliers, an invoicing system also facilitates billing and invoicing . By tracking supplier invoices and payment terms, you can ensure prompt payment and maintain good relationships. Taking advantage of early payment discounts improves cash flow.

In addition to managing customer invoices , an invoicing system provides detailed payment tracking . You can easily view invoice status and identify any late payments that require follow-up.

Integrating a billing and inventory management system with your invoicing system further streamlines payments . Automating payment approvals and processing saves time and minimizes errors, improving overall efficiency.

Payment analytics provided by the invoicing system offer insights into payment trends. Analyzing data helps identify patterns and issues, enabling informed decision-making and process optimization.

With mobile payments becoming more prevalent, a responsive invoicing system that allows clients to make mobile payments is essential. This enhances customer convenience and reduces payment delays.

In conclusion, an efficient invoicing system with integrated payment gateway tools helps track outstanding payments and reduces delays. Secure payment options, automated processing, and payment analysis improve cash flow and ensure timely payments , contributing to business success.

Customize Your Invoices to Reflect Your Brand Identity

When it comes to generating invoices , it is important to have a modern and professional look that reflects your brand identity. A customized invoice not only adds a personal touch but also helps to build trust and credibility with your clients. With a user-friendly invoicing system, you can easily create and send professional invoices that align with your brand ‘s colors, logo, and overall aesthetic.

Furthermore, a customizable invoicing system allows you to add important details such as payment terms, insurance information, and any other relevant information specific to your business. This ensures that your clients have all the necessary information at their fingertips, making the payment process smoother and hassle-free.

In addition to customization options, a good invoicing system should also provide notifications and reminders to keep you updated on the status of your invoices . A secure and reliable payment processing platform will send out payment notifications to both you and your clients, ensuring that everyone is informed about the transaction. This not only helps with payment tracking but also assists in reconciliation and keeping your finance records in order.

With the advancement of technology, a modern invoicing system should also offer a mobile payment solution. This allows your clients the flexibility to make payments on the go, through their preferred payment methods. Whether it’s through credit card, online banking, or mobile wallets, a good invoicing system will ensure a seamless and secure payment experience.

Business analytics and reports are also crucial when it comes to managing your invoices and financial records. A robust invoicing system should provide you with detailed reports and insights into your payment transactions, allowing you to analyze trends, identify areas of improvement, and make informed business decisions.

Lastly, a customizable invoicing system should offer features such as payment reminders and approval workflows. Payment reminders help to reduce the chances of overdue payments and improve cash flow, while approval workflows ensure that invoices are reviewed and authorized before being sent out. This helps in maintaining transparency and accountability within your organization.

In summary, a customizable invoicing system with modern features such as notifications, user-friendly interface, mobile payments , business analytics, approvals, and customizable invoices allows you to streamline your invoicing process and reflect your brand identity in a professional manner. With secure payment gateway solutions and advanced features, you can ensure prompt payment processing, efficient financial management, and a seamless experience for both you and your clients.

Generate Detailed Financial Reports and Analytics

Effective financial management is vital for businesses, and invoicing systems play a crucial role in this process. A key feature of modern invoicing systems is their ability to generate detailed financial reports and provide valuable analytics.

These reports offer businesses insights into their revenue, expenses, and overall financial health, allowing them to track their income and expenses over specific time periods. Businesses can generate reports in multiple languages, making them accessible to customers and clients worldwide. Integration with payment gateways ensures accurate and up-to-date financial data by automating payment tracking .

Integration with credit card processing and payment gateway solutions also enables secure online payment processing. Payment alerts can be set up to notify businesses of any missed or delayed payments , preventing cash flow issues.

In addition, the ability to manage recurring payments and invoices simplifies the billing process for businesses with subscription-based models. The system can automatically generate and send invoices on a regular basis, reducing administrative work and improving efficiency.

The invoicing system also facilitates expense tracking by integrating with accounting software and CRM platforms. This integration allows businesses to easily track and categorize expenses, contributing to better financial planning and budgeting.

An archiving feature is also included in the invoicing system, enabling businesses to store and retrieve past billing statements and payment records. This feature is particularly useful for settling disputes or meeting legal requirements.

In conclusion, an invoicing system with comprehensive reporting and analytics capabilities is essential for effective financial management, payment tracking , and informed decision-making. With user-friendly interfaces and secure payment platforms, businesses can streamline their billing processes and provide a seamless experience for their clients and customers across different currencies.